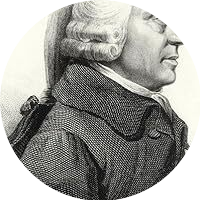

“Every man lives by exchanging.”

― Adam Smith

If you understand how the foreign exchange market works, this is key to making informed decisions with your money.

Central banks with Corporations, interbanks and Financial institutions play a key role in driving the market forward. But only if you know what they are doing and why. You too can stay ahead of the game.

Let’s take a look at the main players in detail. And the impact on the Forex market.

When we buy and sell currency, we’re doing Forex (foreign exchange) marketing.

There are more than 100 official currencies in the world, but most international businesses use just a few such as the US dollar, Euro, and Yen.

Several important groups are involved in this market. And they trade in different ways including buying and selling instantly (instant/spot transactions), subsequent trade (swaps), price bets (option contracts) and agreements to trade in the future (forwards).

Central Bank

Central Banks are very important in the Forex market. They set interest rates and make decisions which can change the value of their currency.

Central Banks decide how money is traded around the world. They do this in three main ways:

- Pegged (where the value of a currency is tied to another currency),

- Fixed (where the value of the currency remains the same), and

- Floating (where the value can change based on supply and demand).

Central Banks and governments sometimes change the value of their currencies. For example, if a country’s price drops (deflation), the central bank wants the national currency to become cheaper. They do this by creating more currency and using it to buy money from other countries. This can make exports (goods sold to other countries) cheaper and more attractive.

Forex traders are paying attention to what central banks are doing. Because these actions can create better income-generating opportunities for them.

Interbank Marketing

The Interbank Market is where most currency trading takes place. It is a network where banks trade money with each other.

Do they do this for their customers or to make a profit for themselves?

Banks make money from trading by charging spreads. It’s the difference between the buying price and the selling price of the currency.

Businesses

A company or organisation buying and selling goods including services in other countries.

Currency transactions are also required. For example, if a European company purchases shares from a U.S. company, it then sells the product to a company in South Africa. The company will use a different currency. The South African Rand must first be converted to Euros. Then convert Euros to US Dollars.

Paid shares to American companies may need to be converted to Dollars.

To protect yourself from sudden changes in currency values, these companies can buy the currency outright, or enter into a swap agreement.

Swap agreements allow them to get the foreign currency they need in advance. This is to prevent them from losing money if the exchange rate suddenly changes.

Hedge Funds & Investment Managers

Investment/Portfolio Managers, Hedge Funds and Pooled Accounts are the second-largest players in international markets after banks. These managers often trade currencies for large accounts, such as pension funds or endowments.

When these companies manage international investments, they need to buy and sell currencies to trade foreign stocks and bonds. They also sometimes engage in speculative trading.

This means they buy and sell currencies in an attempt to make a profit.

Main Players

The biggest players in the forex market are:

- Banks.

- Investment management companies and hedge funds

- Businesses

Central banks have great influence in this role, while retail investors play a lesser role.

Understanding how these groups interact in the forex market can help you see the bigger picture of how global currency trading works.

Action for the Day

- Pick a major player in the forex market – central banks, banks or corporations.

- Research how they affect currency prices, and

- Write down one way you can use this information to improve your trading strategy.

- Start with something simple, but make sure you follow through.

Wrap Up!

The Forex market is shaped by many different forces. From central banks to investment managers. By paying attention to the performance of each player, you can make better decisions. And then take advantage of opportunities. So stay informed and be prepared to adjust your strategy regularly.

Interesting, right? Yep! Go figure Rothschild(e)!

Did You Know...

“…the Microsoft Teams app on your computer desktop is getting a cool update called, Spatial Audio. It’ll make it sound like everyone on your video call is in the room with you! It’ll help you understand each other better, especially when people are talking over each other. So get ready to stop, collaborate and listen with Teams! Weird but interesting!”

Tech-Tip 101 INSIDER SECRET:

Home Security Camera Tips for Your Safety

“When setting up your home security cameras, where you put them is very important for your safety. Here are three rules to remember. Make sure you can see windows and doors on the ground floor.

- Put your cameras high up so they can see more of the area.

- The corner of a room is a great place!

- If you have a video doorbell camera, place it about 48 inches from the floor.

Following these rules will help you get the best coverage and keep your home safe!”

Be on the Alert!

“If you ever feel that someone’s snooping around or looking at your emails, this could be real or just paranoia. But there are 4 ways you can find out about it:

- Find your email account or security settings.

- There should be a section called ‘Recent Activity’, ‘Security’ or ‘Login History’.

- See if there are any logins from places or devices you don’t recognise.

- If you’re sure it’s not you, change your email password and turn on two-factor authentication for extra security.

But if everything seems normal, remember that you could be wrong.”

Best,

R Bismarck

Don't miss article like this!